Transporting lithium-ion batteries internationally is a complex and highly regulated process. With their flammable nature and strict shipping restrictions, businesses must adhere to stringent lithium-ion battery export regulations to avoid fines, delays, or even safety hazards. From lithium-ion battery/reefer containers to specialized dangerous goods shipping, every detail matters.

Nissin Belgium LIB Village is a leading expert in lithium battery transport, offering safe, compliant, and cost-effective logistics solutions. Our extensive experience in lithium battery freight services ensures smooth and risk-free transportation, whether by air, sea, or land.

This guide explains the key challenges, regulations, and best practices for shipping lithium batteries overseas and why Nissin Belgium is the best partner for your global shipping needs.

1. Safety Risks & Dangerous Goods Classification

Lithium-ion batteries are categorized as Class 9 Dangerous Goods under international transport regulations due to the risk of fire, explosion, and thermal runaway. This classification imposes strict handling and shipping requirements, including:

1. UN-Certified Packaging – Lithium-ion batteries must be enclosed in packaging that prevents leaks, short circuits, and physical damage.

2. Temperature-Controlled Storage – Large-scale shipments require reefer containers to maintain a stable temperature and reduce overheating risks.

3. Specialized Handling – Only trained professionals can handle these batteries to minimize damage during loading, unloading, and transit.

2. Complex Lithium-Ion Battery Export Regulations

Each mode of transport—air, sea, or land—has different lithium-ion battery export regulations that must be followed. Failing to comply can result in shipment rejection, fines, or confiscation.

Air Freight (IATA Dangerous Goods Regulations)

1. State of Charge (SOC) Limits – Batteries must be transported at 30% SOC or lower to reduce fire risks.

2. Passenger Aircraft Ban – Standalone lithium-ion batteries (UN3480) cannot be shipped on passenger planes and must be sent via cargo aircraft only.

3. Mandatory Labeling – Shipments must display a “Cargo Aircraft Only” label and proper hazard symbols.

Sea Freight (IMDG Code – International Maritime Dangerous Goods Code)

1. UN-Certified Packaging Required – Ensures safety against leaks, vibrations, and potential short circuits.

2. Dangerous Goods Declaration – Required for customs clearance and transport approval.

Land Freight (ADR & DOT Regulations)

1. United States (DOT – Department of Transportation) – Special permits required for bulk lithium battery transport.

2. European Union (ADR – Agreement concerning the International Carriage of Dangerous Goods by Road) – Transporters must undergo specialized training for handling dangerous goods.

To navigate these complex rules, Nissin Belgium ensures full compliance by handling all necessary documentation, customs procedures, and packaging requirements.

3. Packaging & Labeling Challenges

Improper packaging and labeling are the primary reasons for shipment delays and customs rejections. Lithium-ion packaging requirements include:

1. Shock-Resistant Packaging – Protects batteries from external pressure and impact during transport.

2. Non-Conductive Separators – Prevents battery terminals from touching, reducing short-circuit risks.

3. Fire-Resistant Insulation – Essential for high-capacity battery shipments.

4. Proper Labeling (UN3480 or UN3481) – Ensures easy identification and regulatory compliance.

We offer customized packaging solutions that meet all global battery shipping guidelines, helping businesses move their lithium-ion batteries through customs efficiently.

Best Practices for Safe Lithium-Ion Battery Shipping

1. Work With a Certified Lithium Battery Freight Service

Not every logistics provider is equipped to transport lithium-ion batteries safely. Choosing a company with dangerous goods shipping expertise ensures:

1. Compliance with IATA, IMDG, and ADR guidelines for international transport.

2. Proper documentation and labeling to meet regulatory requirements.

3. Safe handling, packaging, and reefer containers for secure transit.

2. Use Temperature-Controlled Reefer Containers

Lithium-ion batteries are highly temperature-sensitive. Exposure to extreme heat or cold can lead to:

1. Battery Degradation – Shortens battery life and affects performance.

2. Fire and Explosion Risks – Thermal runaway occurs when a battery overheats and ignites.

3. Regulatory Non-Compliance – Some countries require temperature-controlled transport for high-capacity battery shipments.

3. Choose the Right Freight Method

Each mode of transport has its advantages and limitations:

1. Air Freight – Fastest but highly regulated with strict restrictions on lithium battery shipments.

2. Sea Freight – Best for bulk lithium battery transport, with reefer containers available for temperature control.

3. Land Freight – Ideal for regional distribution, but subject to ADR and DOT regulations.

4. Verify Documentation Before Shipping

Incomplete or incorrect paperwork causes customs delays and may result in shipment rejection. Every lithium battery shipment must include:

1. Material Safety Data Sheet (MSDS) – Lists battery composition, potential hazards, and safety handling instructions.

2. Dangerous Goods Declaration – Required for air and sea freight, detailing the shipment’s classification.

UN38.3 Test Report – Confirms batteries have passed international transport safety tests.

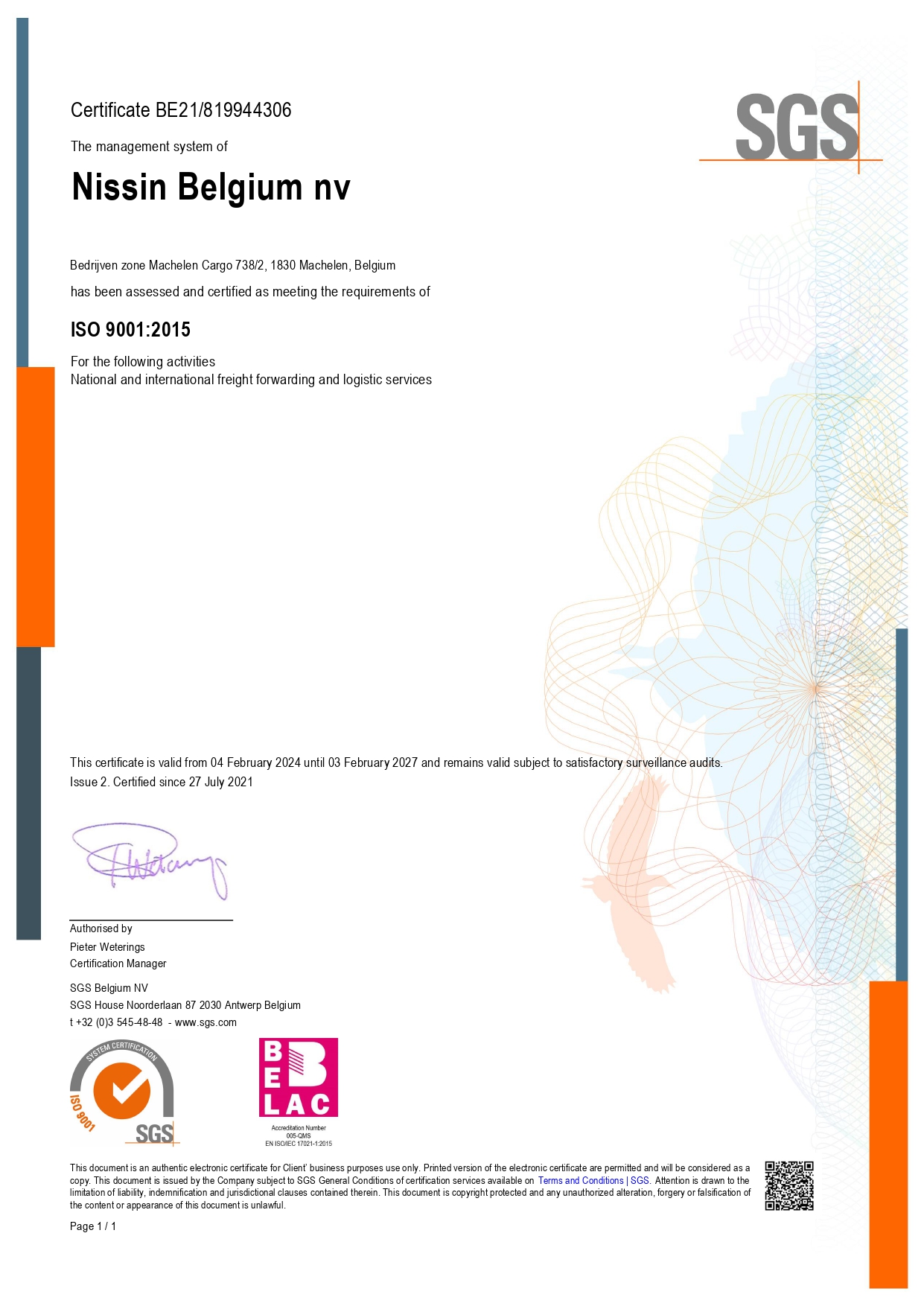

Why Nissin Belgium LIB Village is the Best for Lithium Battery Shipping

1. Industry-leading expertise in Dangerous Goods Shipping

With years of experience handling international lithium battery transport, Nissin Belgium guarantees:

1.1 Regulatory compliance with global transport laws.

1.2 Efficient customs clearance and risk management.

1.3 Specialized shipping solutions for high-value lithium battery materials.

2. Advanced Packaging & Handling Solutions

2.1 UN-certified packaging materials – Protects batteries from impact and leakage.

2.2 Custom packaging solutions – Designed for different lithium battery types.

2.3 Proper labeling & compliance assistance – Ensuring smooth customs clearance.

3. Temperature-Controlled Lithium-Ion Battery/Reefer Containers

Nissin Belgium provides advanced climate-controlled reefer containers, ideal for:

3.1 Long-distance international lithium battery transport.

3.2 Preventing temperature fluctuations that can cause battery damage.

3.3 Protecting shipments from extreme weather conditions.

4. Global Network & Fast Shipping Solutions

With a strong global logistics network, Nissin Belgium offers:

4.1 Faster customs clearance and optimized shipping routes.

4.2 Real-time tracking for all lithium-ion shipments.

4.3 Reliable delivery across Europe, Asia, and North America.

5. Compliance & Risk Management Support

Navigating lithium-ion battery export regulations is complex, but Nissin Belgium provides:

5.1 Expert guidance on legal requirements for different markets.

5.2 Risk mitigation strategies for high-value shipments.

5.3 Specialized compliance teams to handle all paperwork.

Final Thoughts

Shipping lithium-ion battery materials overseas is a complex process requiring expert knowledge and strict compliance with international regulations. Choosing the right logistics provider is essential to avoid costly mistakes and shipment delays.

Nissin Belgium LIB Village stands out as the best choice for safe, compliant, and efficient lithium battery transport. With expert knowledge, temperature-controlled reefer containers, and a global logistics network, we ensure smooth international shipping with minimal risks.

For businesses seeking reliable and secure lithium-ion battery shipping and storage, Nissin Belgium provides expert logistics solutions tailored to meet strict safety and regulatory requirements. Contact us today at +32 2 751 44 99 or email HowCanIHelpYou@be.nissin-eu.com to learn more about our specialized services.

Ship smarter. Ship safer.